Faster processing, accurate payouts

Bid farewell to cumbersome Excel sheets and payroll computation errors. Welcome 100% statutory compliance, on-time disbursement of salaries and stress-free month ends.

Be a star with greytHR

greytHR: the ultimate HR software enhancing employee satisfaction, cutting rework, ensuring compliance, and bolstering your employer brand.

Speed

Trust

Accuracy

Reliability

Paying attention toevery little detail.

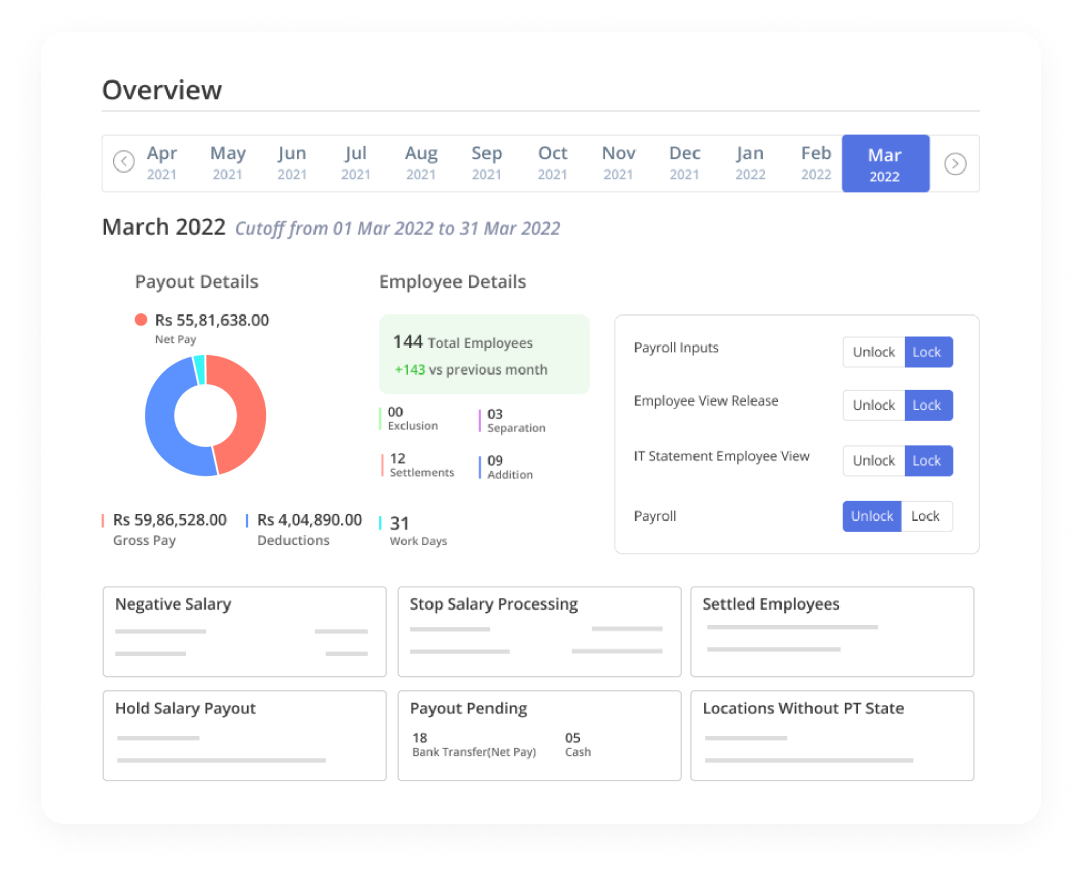

Payroll with greytHR is very thorough and complete. No stone has been left unturned in creating the most exhaustive payroll software available in the market today. No detail ignored. No situation overlooked.

After serving tens of thousands of clients, we can confidently say that if it’s part of payroll, greytHR has it covered. From inputs to payouts, claims to compliances, and self-service to settlements. greytHR puts you in control of the full payroll cycle, and not mere bits and pieces.

Why pedal through the payroll cycle when you can race along with greytHR?

Click, zap, zoom

through payroll processing

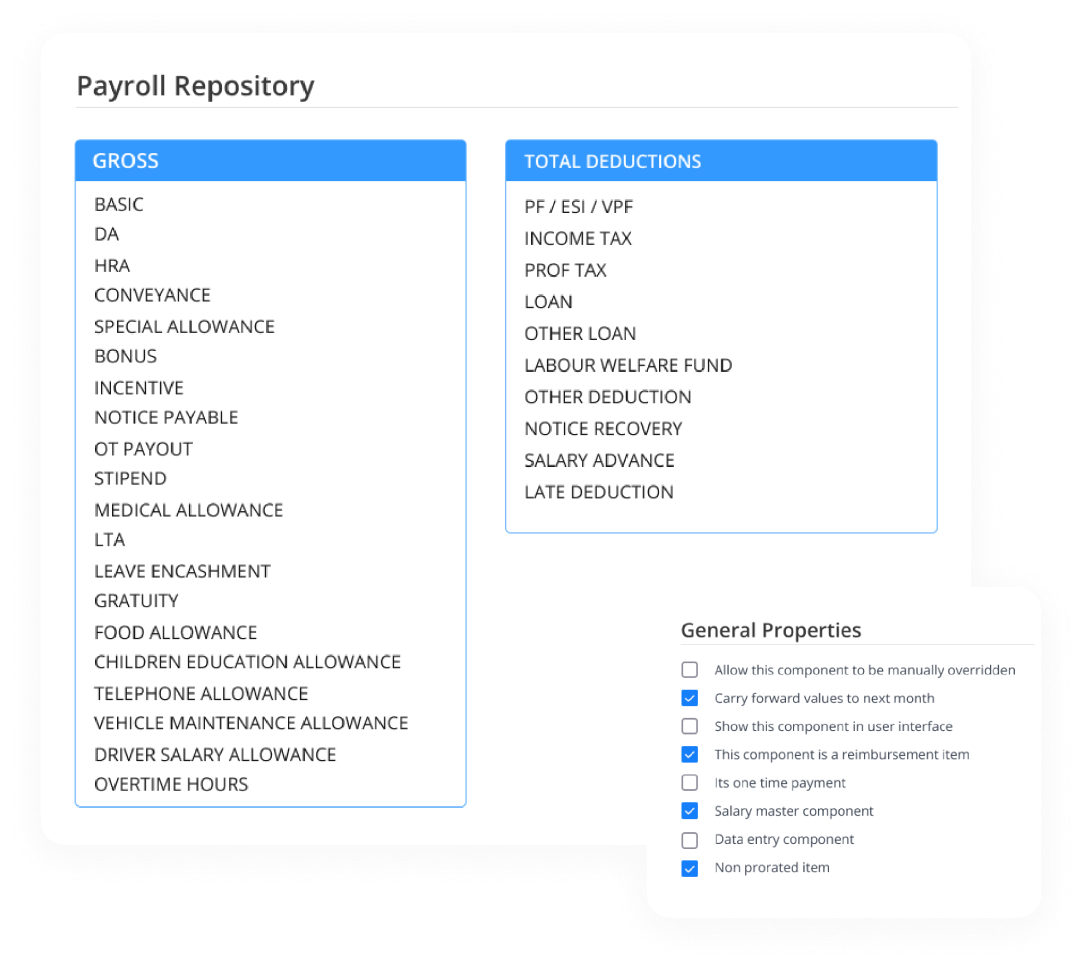

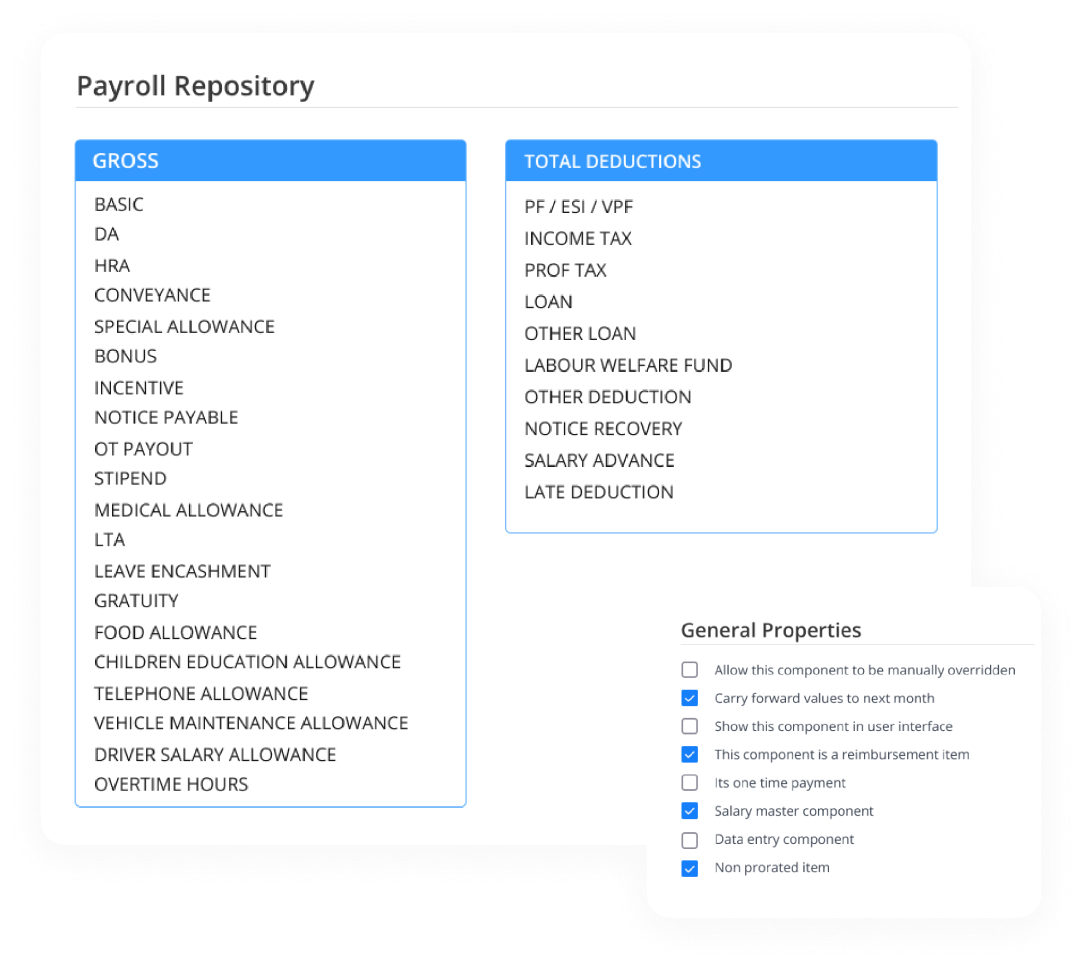

When it comes to Payroll & HR software, greytHR takes the tape far ahead of any others in the race. Let’s take a look at the features that make greytHR the only platform you must consider for payroll processing.- Highly customisable salary structures

- Highly configurable payroll engine

- Unlimited salary components

- Handles even the most complex use cases

Statutory compliance

A piece of cake

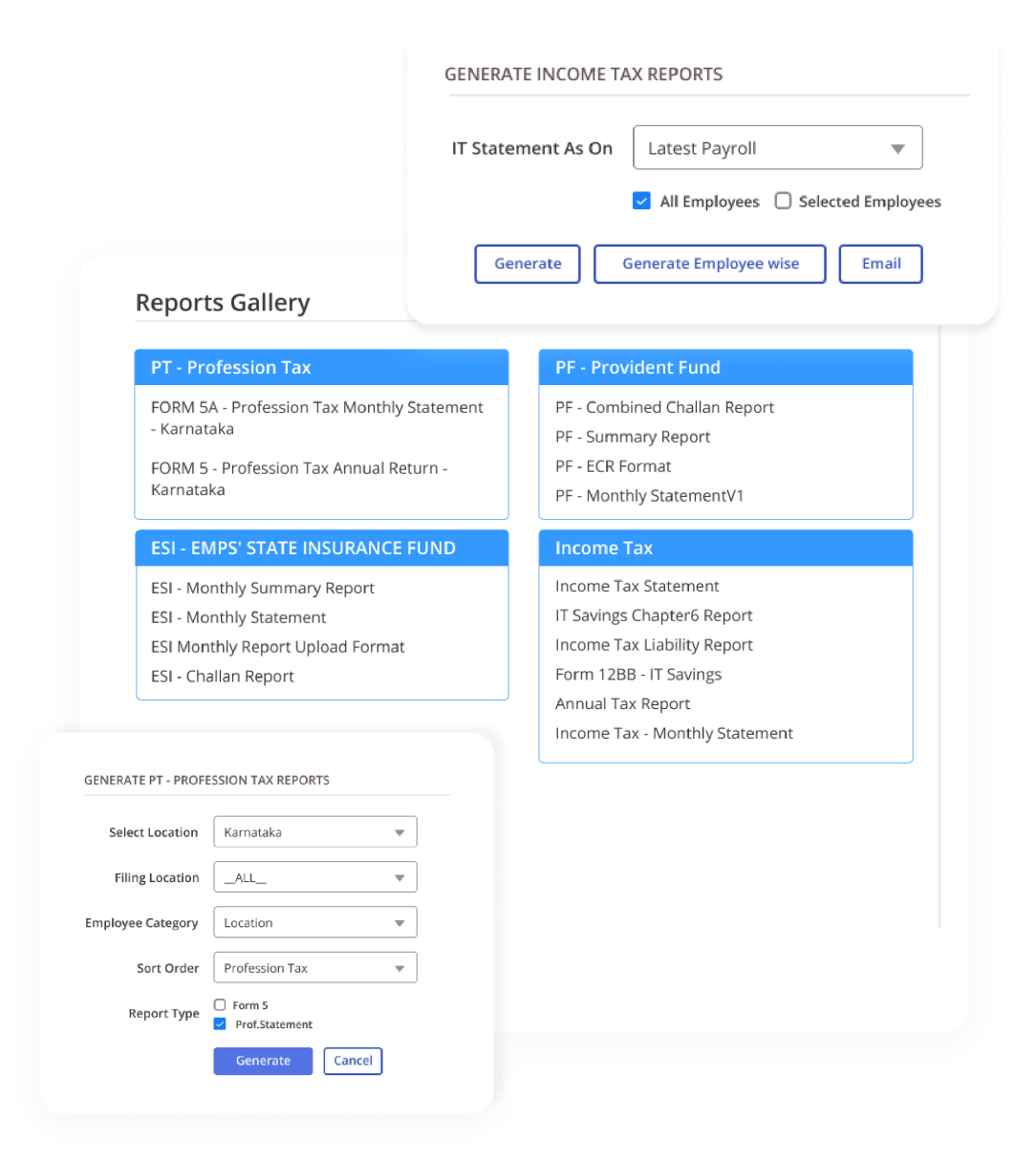

Why spend precious time keeping track of changes in statutory compliances - tax slabs, labour law updates etc.? Free yourself from the burden by leaving it all to greytHR.- PF calculations with ECR generation

- ESI computations and challans

- PT with all state-specific rules built-in

- Comprehensive TDS (IT) calculations and eTDS returns

- One-click Form 24Q generation with automatic FVU validation

- Digitally signed Form 16 and 12BA generation

- Bonus calculations and reporting

- Labour Welfare Fund calculation and deductions

Smooth payday

Take the greytHR way

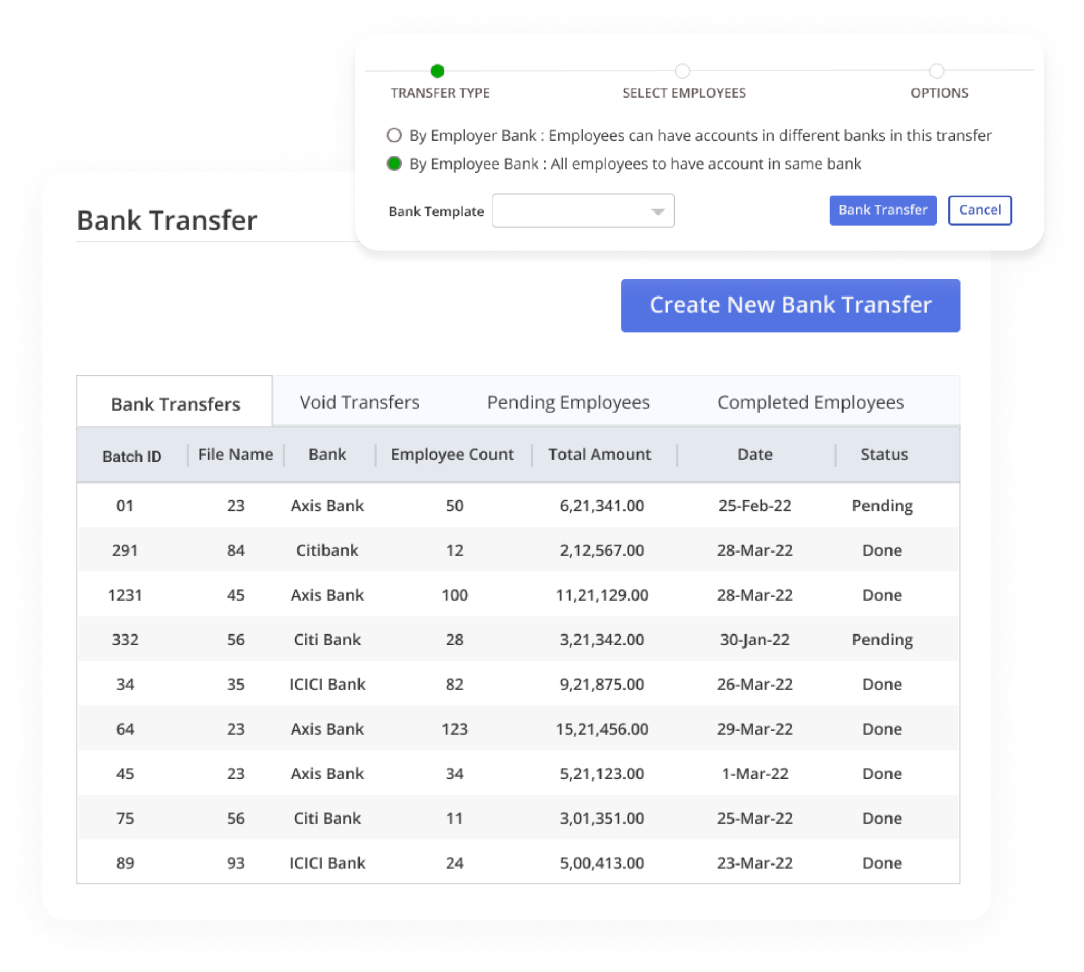

Ensure 100% accurate calculation of salaries, and on-time disbursement, every month. With greytHR, you’ll always be winning hearts and never letting spirits drop.greytHR PayNow: With our direct-debit facility, transfer salaries directly from within the application to the employees bank account in no time. Experience the future of salary payments, today!

- Electronic bank-transfer formats for all major banks

- Batch-wise and bank-wise payment release

- Status tracker for cash and cheque payments

Get rid of stress

With ESS

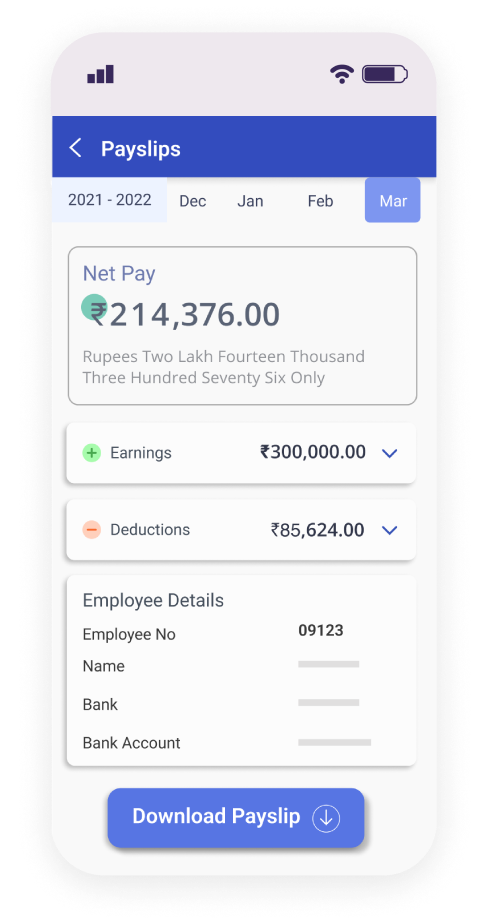

greytHR’s Employee Self-Service portal reduces administrative work by 80% and delivers a world-class employee experience through exclusive features and facilities. To add even more convenience, the ESS can be accessed via a mobile app or through the web.

- Reimbursement claims with automatic policy enforcement.

- Online submissions for smooth operations

- PIT Declarations

- POI

- Payroll information for greater transparency and fewer queries.

-

YTD statements

-

IT Statements

-

Payslips

-

Form 16s

- Workflows & Help desk for better employee servicing.

Reports and analytics

A free pass to world-class

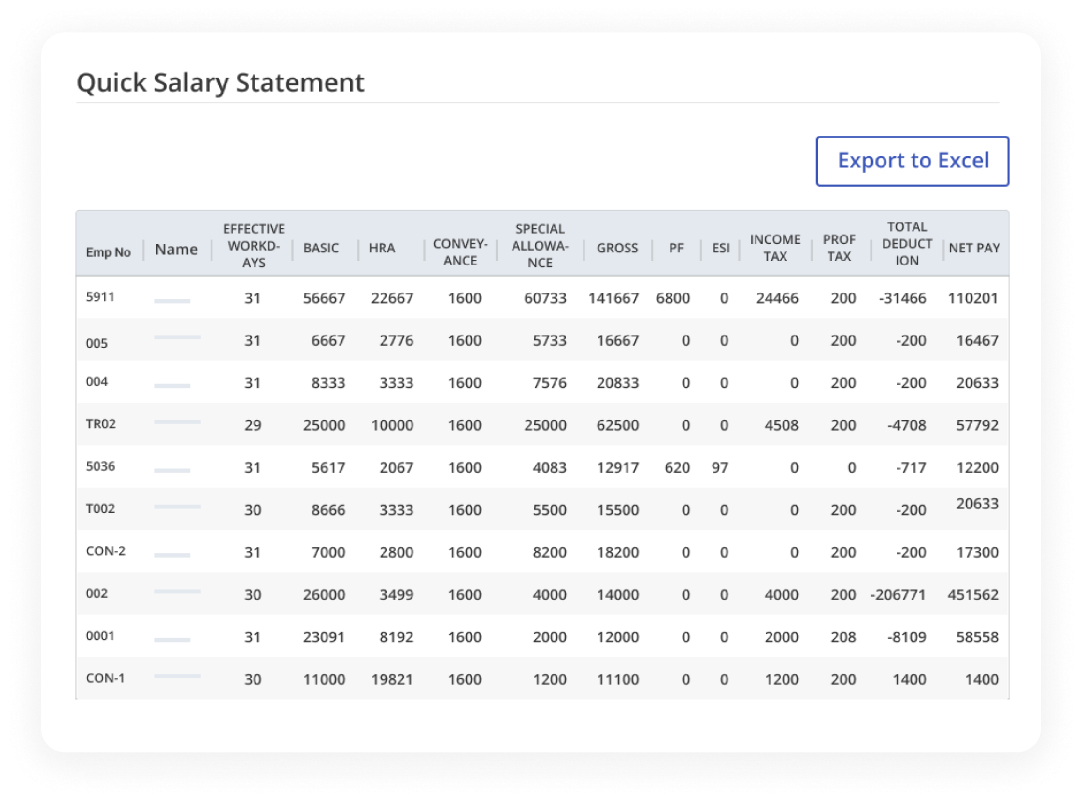

greytHR gives you access to hundreds of ready-made MIS and compliance reports. Additionally, you can build and customize reports to your specific needs. greytHR also delivers insightful payroll analytics that help you with accurate and timely decision making.- MIS and reconciliation reports

- Reports for statutory compliance

- Payroll Statement Builder

- Ad Hoc queries with QueryBuilder

Click, zap, zoom

through payroll processing

When it comes to Payroll & HR software, greytHR takes the tape far ahead of any others in the race. Let’s take a look at the features that make greytHR the only platform you must consider for payroll processing.- Highly customisable salary structures

- Highly configurable payroll engine

- Unlimited salary components

- Handles even the most complex use cases

Statutory compliance

A piece of cake

Why spend precious time keeping track of changes in statutory compliances - tax slabs, labour law updates etc.? Free yourself from the burden by leaving it all to greytHR.- PF calculations with ECR generation

- ESI computations and challans

- PT with all state-specific rules built-in

- Comprehensive TDS (IT) calculations and eTDS returns

- One-click Form 24Q generation with automatic FVU validation

- Digitally signed Form 16 and 12BA generation

- Bonus calculations and reporting

- Labour Welfare Fund calculation and deductions

Smooth payday

Take the greytHR way

Ensure 100% accurate calculation of salaries, and on-time disbursement, every month. With greytHR, you’ll always be winning hearts and never letting spirits drop.greytHR PayNow: With our direct-debit facility, transfer salaries directly from within the application to the employees bank account in no time. Experience the future of salary payments, today!

- Electronic bank-transfer formats for all major banks

- Batch-wise and bank-wise payment release

- Status tracker for cash and cheque payments

Get rid of stress

With ESS

greytHR’s Employee Self-Service portal reduces administrative work by 80% and delivers a world-class employee experience through exclusive features and facilities. To add even more convenience, the ESS can be accessed via a mobile app or through the web.

- Reimbursement claims with automatic policy enforcement.

- Online submissions for smooth operations

- PIT Declarations

- POI

- Payroll information for greater transparency and fewer queries.

-

YTD statements

-

IT Statements

-

Payslips

-

Form 16s

- Workflows & Help desk for better employee servicing.

Reports and analytics

A free pass to world-class

greytHR gives you access to hundreds of ready-made MIS and compliance reports. Additionally, you can build and customize reports to your specific needs. greytHR also delivers insightful payroll analytics that help you with accurate and timely decision making.- MIS and reconciliation reports

- Reports for statutory compliance

- Payroll Statement Builder

- Ad Hoc queries with QueryBuilder

Meet the clients who made us No. 1.

Rated 'Leader' on G2