A key responsibility of the finance and payroll team is collecting and verifying the receipts and investment proofs of employees. Employees project their investments at the beginning of the financial year in their IT Savings Declaration forms. Around the year-end, the finance teams start collecting the proofs of investments to verify their authenticity and calculate the income tax accordingly.

Keeping up with the ins and outs of collecting and verifying the proofs is a complicated affair for the employers. This complete guide provides all the information you need to know about processing employees’ proofs of investment. So, let’s dive in!

Table of Contents

- 1. The Need for Collecting Investment Proofs

- 2. The POI Window

- 3. 7 Steps to Process Investment Proofs

- 4. Common Challenges while Processing POI

- 5. Software to Automate the Proof Collection Process

- 6. The Bottom Line

- 7. Glossary

The Need for Collecting Investment Proofs

By law, employers need to calculate income tax, deduct TDS and remit it, every month. And, employees can save tax through many exemptions and deductions. But, this is allowed only against proper evidence.

As per the CBDT circular, the employer is responsible for collecting the evidence:

The DDO (Drawing & Disbursing Officer) shall also ensure furnishing of the evidence or particulars in Form No. 12BB in respect of deduction of interest as specified in Rule 26C read with section 192 (2D).

However, it’s difficult to insist on documentary proof at the beginning of the year from employees. The investments and receipts only come later in the year. If you do insist, it leads to excess tax deduction, lower take-home salary, massive resentment, and unhappiness.

So, what do we do? There is a simple trick.

At the beginning of every financial year, employers take a declaration from the employees regarding their house rent, savings, investments or sums qualified for deduction or exemption under salaries (typically called an Income Tax Declaration). When calculating the income tax for the employee, the declared exemptions and deductions are factored in. The calculated tax is then divided into equal monthly instalments and is then deducted monthly from the employees’ salaries (Tax Deducted at Source or TDS).

By the last quarter of the financial year, employees must provide documentary proof for exemptions and deductions that they had declared at the beginning of the financial year. The tax deducted in the month of March is based on these proofs alone and not on the basis of declarations. The employer is bound to disallow any claims that are not backed by proper proofs.

You need to verify the submitted proofs for authenticity and eligibility.

Sometimes the employees fail to submit the investment proofs for various reasons. Also, at times the declared investments and the actual investments do not match. These factors may increase or decrease the employee’s tax liability, which is adjusted during the remaining months of the financial year.

The POI Window

When is a good time to collect proofs from employees? It’s a hassle for employees to maintain the proofs for the whole year and then submit it in one shot.

But, is it a good idea for the admin to accept documents from employees anytime, anywhere?

No! Any work that is not streamlined or process-driven leads to interruptions, task-switching and more stress. With all the juggling of tasks, if any proof document gets misplaced, you end up in a big mess. So, collecting proofs at all times is not a good idea.

A best practice is to accept submissions for one or two months during the last part of the year. Some companies do this in December and January and others in January and February.

POI window is the period for which the employer accepts the proofs from the employees. This window ensures a disciplined approach to collect investment proofs ahead of time.

A planned exercise for POI collection and verification can avoid several errors and ensure a smooth workflow. For this, you should decide on the POI window’s start and end date. Also, figure out when and how to announce to employees and other stakeholders about this exercise and the important dates.

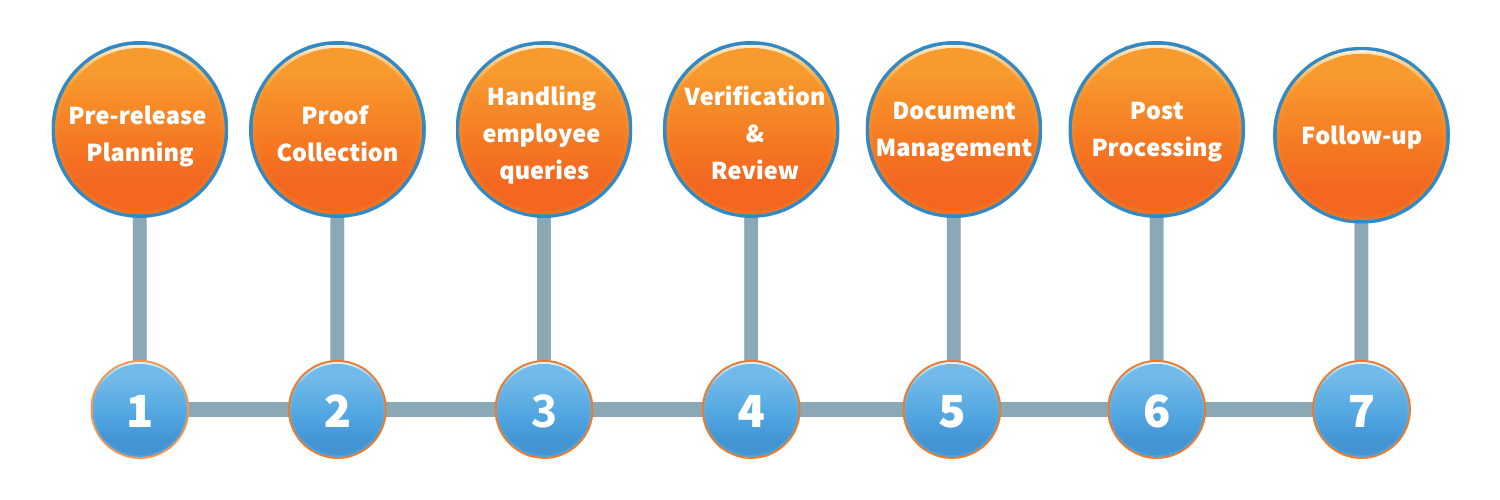

7 Steps to Process Investment Proofs

The process of collecting and verifying proofs of investment has many steps and phases:

Step 1: Planning

Before collecting and verifying POI, chalk-out the whole process, decide how many days the window to submit the POI would be open for employees. Correspondingly, decide on the deadline to submit POI and ensure to communicate the same to your employees.

Step 2: Collection of Proofs

Collect the proofs in paper form (physical documents) or soft copy from employees during the set timeline. Employees submit their investment proof forms and supporting documents via email or by uploading them through an Employee Portal.

Step 3: Resolve Queries

Ensure that your employees are aware of the hows and whats of the POI submission process. Even a minor error can not only affect your employees’ salaries and tax computation but may also become a cause for a notice from the IT department. So, give heed to employees' concerns and make your finance team approachable on call or mail.

Step 4: Verify Submitted POI

In this step, the employer matches the declared investment of the employees with the actual proofs. Here, you ensure the completeness and correctness of the POI submitted by employees. After verifying the POI against the IT declaration submitted at the start of the FY, you can accept or reject the POI.

You can refuse POI when the proofs do not match the IT declaration and hold POI when documents are missing or need re-consideration. In both cases, you will need to recollect the POI from employees and re-verify them for their TDS calculation.

If you use software like greytHR, you can send messages to the employees directly if their submitted investment proofs are accepted, rejected or put on hold.

Step 5: Re-Collect POI

Sometimes the POI submitted by employees is incomplete, has invalid information, or does not match the declared IT submitted at the beginning of the year. In such cases, collect the POI from such employees again with the correct information.

Step 6: Re-Verify POI

Much like the earlier verification process, in this step also, you are supposed to verify the POI documents submitted by the employees for re-verification. Based on the analysis of POI, you can accept or reject the submission.

Step 7: Payroll Computation & Follow-Ups

After collecting and verifying investment proofs, we recalculate the Income Tax for the employee and deduct this tax from the salary employees’ in-hand salary based on the income tax calculations. Accordingly, adjust the TDS for the employees. In addition to the computation, there are follow up tasks after collecting the POIs like filing the proofs for future reference. This is done using a sound document management system for organization and quick retrieval.

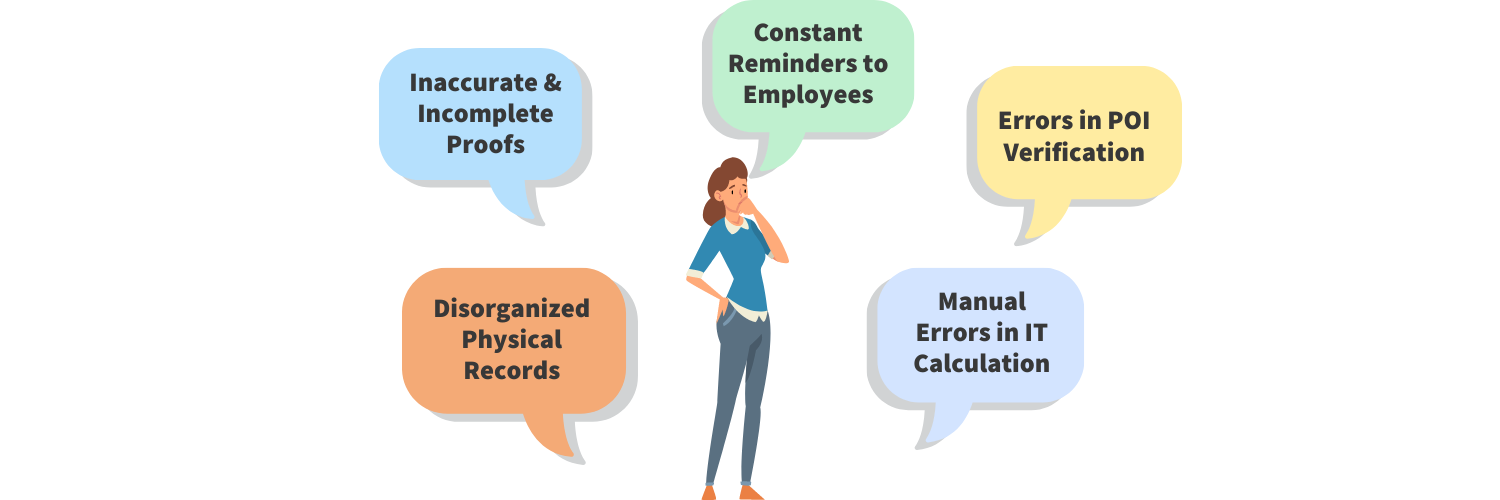

Common Challenges while Processing POI

The processing of employees’ POI is a crucial part of an organization. Even an insignificant glitch may invite a notice from the IT department for correction or explanation due to the complex tax laws. This is why most employers take the advice of professionals or CAs.

Here are some of the challenges that employers confront while processing employees’ POI:

Disorganized Physical Records

For any organization, organizing the proofs is a significant concern. This is because each employee submits proof of investment form with at least three supporting documents (Our data based on reviews of lakhs of transactions indicate an average number of three documents per employee). Hence, when the whole workforce submits these documents physically, it becomes tough for the finance team to manage and arrange all the documents in one place. This leads to chances of misplacing or missing the documents.

Inaccurate & Incomplete Proofs

One of the common lapses while collecting documents is the inaccuracy and incompleteness of the documents submitted. In many instances, the employees provide supporting investment proofs that are not accurate or have incomplete information, leading to re-collection. This delays the process and increases the task for the finance team as it re-verifies the proofs again.

Constant Reminders to Employees

Many-a-times, the employees fail to submit the proofs even after constant reminders. Hence, reminding the critical dates to employees is a common challenge. Sometimes, the employers would need to do specific follow-ups with employees individually if they fail to submit the proofs within the specified POI Window.

Errors in POI Verification

Errors in the verification of submitted proofs are rare but possible. As the verification is done manually, the process is prone to human errors. This can lead to errors in the computation of the payroll and tax to be submitted.

Manual Errors in IT Calculation

Similar to errors in POI verification, the finance team may compute employees’ taxes incorrectly. This error can lead to miscalculated taxes and errors in the whole salary calculation and tax submission process. Such errors will invite notices from the IT Department.

Software to Automate the Proof Collection Process

For professional and organised IT and POI management, good proof collection software is a big convenience. A POI Collection and Verification solution reduces the finance team's manual effort, simplifies the process and saves a lot of time for everyone.

There are two categories of software tools for two distinct user groups.

- Admin tools for finance and payroll teams

- Employee self-service portal for employees

Admin Portal for Finance & Payroll Teams

An automated POI collection and verification software provide the following benefits to an admin:

- No hassles in tracking employees’ submission and approval statuses of proofs

- No stress of organizing the database manually

- No loss of time in explaining reasons for rejections using comments or notes facility

- Timely communication with employees regarding the status of their proofs submission, leaving no ambiguity to the process

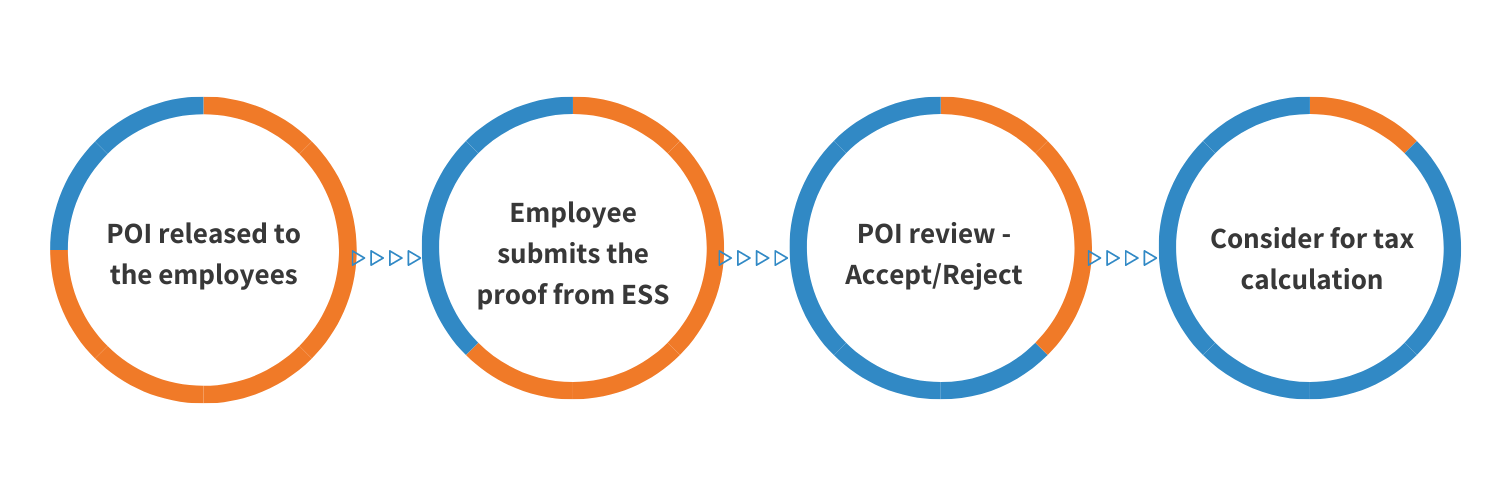

Using the software, the entire process of proof collection and verification is done in 4 phases:

- POI Yet to be Released

The admin prepares for releasing the POI collection for the employees. This step involves planning the timeline of the whole process and communicating the submission dates to the employees.

- POI Released

The admin releases the POI and the employees submit their proofs of investment form along with supporting proofs. The admin sends reminders to employees about the pending submissions during this window. Once the proofs are submitted, the employees are notified about the successful submission.

- Locked & Pending

In this step, the admin reviews the submitted proofs. If the proofs match the investment declaration form, the proofs are considered for submission. Otherwise, the employees are communicated to re-submit their proofs with corrections.

- Locked & Reviewed

In this final step, the pending reviews of employees’ proofs are verified. Once the review is done, and the admin validates all the proofs, they are pushed for payroll computations. After the POIs are considered, the employees can access and preview their submitted POIs.

Employee Portal

An employee self-service portal to submit POI for employees can help them stay updated with the deadlines and related information.

With the employee portal, employees declare their IT investments at the beginning of the year, figure out the best IT declaration plan to save income tax, and ensure that correct tax deductions happen.

By the last quarter, the admin opens the window to provide proof of investments. The employees can then submit their proofs and check the status of their submissions online. The key benefit of an employee portal for proof collection is that employees can provide the proof at a convenient time from home or office. This is especially important when a large number of employees are working from home and providing proofs in person is not feasible and very inconvenient.

The Bottom Line

Investment proof submission is a long and tedious process involving paperwork and keen attention to details. A system with pre-planned procedures and timelines can help employers in timely processing of the employees’ investment proofs. We hope that this article gave you a glimpse of the process of investment proof submission along with the tips to simplify it. If you want to automate your company's proof of investment submission process, please reach out to us here. We will get back to you as soon as possible.

Glossary

This article assumes that you are familiar with certain income tax concepts. But if this is all new for you, the following sections provide a brief overview of the topics. We recommend that you also catch up on the detailed guides and articles on our website related to payroll management, statutory compliance and income tax.

Income Tax

Passed in 1961, India's Income Tax Act handles all income tax provisions and any tax deductions that may be applicable. The Government charges a direct tax from your employees in the form of income tax. The paid tax forms a large part of the country's revenue, managed by the Central Board of Direct Taxes (CBDT).

Dual Tax Regimes

The Union Budget 2020 introduced a new income tax regime with lower tax rates, effective from April 1, 2020. However, as part of the new regime, the government also withdrew many exemptions and deductions from the old regime. To provide a smoother transition to the new regime, the government has allowed employees to file their returns using either of the two regimes.

While the two tax regimes may be beneficial for the employees, it is just more work for the administrators. Now, the verification of investment proofs happens with reference to not one but two sets of income tax rules.

The tax slab rates as per the Old and New regime are as follows:

TDS

TDS or Tax Deducted at Source is the tax collected at the source from where an individual's income is generated. Since your employees are individuals receiving a salary, they are liable to pay income tax. The government’s TDS provisions ensure the deduction of income tax before you pay the wages to employees. As TDS is deducted right at the source, it helps check tax evasion and also relieves your employees from the burden of paying taxes at the end of the financial year (FY). Hence, the TDS mechanism allows both a steady inflow of revenue to the Government and reduced financial strain for taxpayers.

Investment Proofs

Your employees can utilize the tax-saving options to reduce the taxable income and consequently, the tax. They can do this by submitting documents declaring their yearly expenses on House Rent and the investments that they propose to make in the financial year. As these documents assist in proving their investments, they are called proofs of investment (POI).

Tax Saving Salary Components & Investments

Structuring a salary is of utmost importance for an employee to minimize the tax burden. The salary structure has several components that are fully or partially taxable, while others are fully exempt. Here, we list some of the salary components that can help employees to plan their tax-saving.

Components with Exemptions

Income tax exemptions (under section 10 of the Income Tax Act), are part of the salary not included in calculating the tax liability. Major exemptions include:

Entertainment Allowance

Children Education Allowance

Other Components

Mobile Reimbursement

Food Coupons

High Active Field Area Allowance

Special Compensatory Allowance

Tribal Allowance

High Altitude Allowance

Tax Deductions

An income tax deduction, defined under Section 80C to 80U of the Income Tax Act, is the amount deducted from their gross income to calculate the tax liability. Major deductions include:

Deduction under section 80C

Life Insurance Premium

Equity Linked Savings Scheme (ELSS)

Employee Provident Fund (EPF)

Unit Link Insurance Plan (ULIP)

Annuity/ Pension Schemes

Principal payment on home loans

Tuition fees for children

Contribution to PPF Account

Sukanya Samriddhi Account

NSC (National Saving Certificate)

Fixed Deposit (Tax Savings)

Post office time deposits

National Pension Scheme

Deduction under section 80D for medical insurance premium

Deduction under section 80TTA Or 80TTB for saving bank interest

Deduction under section 80G for donations, etc.

Tax Planning by Availing Provisions & Deductions

The Government lets employers plan and structure their employees’ salaries so that they are tax-efficient and help them save tax by availing exemptions on several allowances included in their income or by availing non-taxable allowances.

These tax savings include tax deductions and exemptions. In the old tax regime, the government provided relief to people for various important expenses like school fees, home loan repayment, etc. To incentivize good financial and retirement planning, the government also allows employees to claim deductions for various investments and expenses.

- Standard Deductions, Entertainment allowances, Employment/ Professional tax. (Under section 16)

- House Rent Allowance (HRA)

- All chapter VIA section - 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EEA, 80EEB, 80G etc {Excluding Section 80CCD(2)}

- Leave Travel Concession (LTA)

- Under section 10(14) - Special Allowance such as Children education allowance, Hostel Allowance, Transport Allowance, Uniform Allowance, etc

- Under section 24 - Interest on borrowed loan for a self-occupied property.

- Set off of any loss, under the head “Income from house property” with any other head of income.