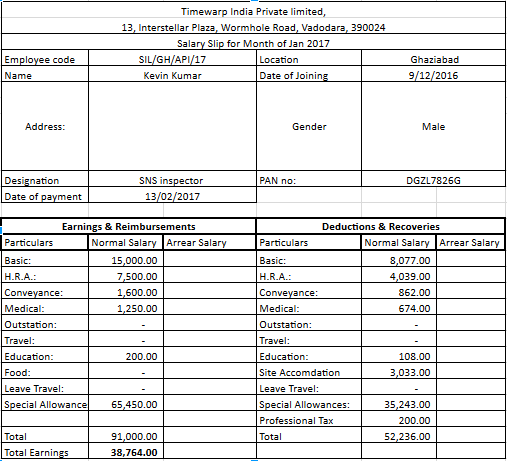

Payslips cannot be generated using spreadsheets alone. It takes a macro to get the job done, after which the individual payslips have to be converted into PDFs to be published. Simple, you say? Well, here’s a closer look at manual payslip generation that’ll do away with that illusion.

Manual cross-verification required

If you’re using a macro for payslip generation, you will have to ensure that the values on the payslips are identical to those on the salary register. Such cross-verification can take up to 3 days for around 100 employees. In terms of time, that’s a heavy price to pay each month.

Employee-wise data extraction and conversion

When using a macro for the purpose of payslip generation, the data for all the payslips to be generated gets collated on a single spreadsheet. This data has to then be extracted employee-wise and then each payslip converted into a PDF separately. This causes the time and effort required for the task to rise exponentially compared to software.

Single format only

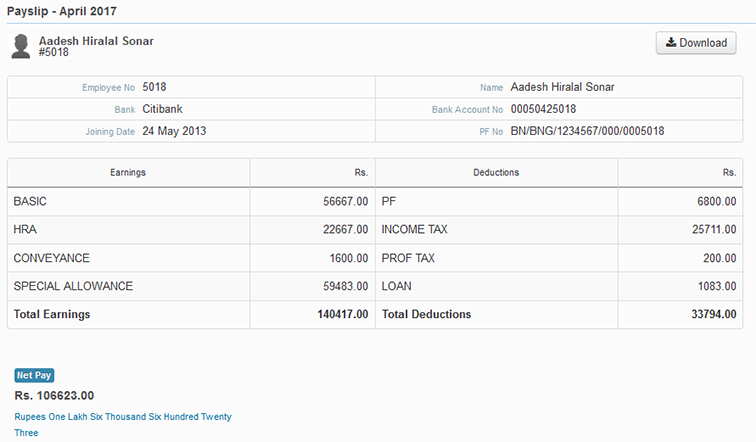

The use of a software for payslip generation offers you a number of formats to work with, adding to the flexibility for you - the user. This is not the case with manual payroll generation, where values will have to be entered into a set of pre-populated spreadsheet cells. Also, each payslip has to be formatted separately.

Fig 1: Sample Excel payslip

Fig 1: Sample Excel payslip

Fig 2: Sample software-generated payslip

Edits not possible

Once every while, there arises a need for post-release salary changes. These are essentially not possible when using a macro for payslip generation. The only method that can be adopted then is a virtual re-run of the process. That is, you would need to incorporate the changes into the salary register, then convert it into a spreadsheet, followed by separation into individual payslips, conversion into PDF and, finally, send-out to employees.

RELATED POST: Structuring FBPs for tax planning and efficient compensation

Errors due to linkage to salary register

A macro picks up identical values as are present on the salary register, which is essentially a spreadsheet. Any inadvertent changes to the salary register, which are easy to occur when one is working with a spreadsheet, can hence result in erroneous payslips. When using a payroll software, the salary register does not affect the payslips as values are picked up directly from the software, and involves no error-prone spreadsheets whatsoever.

Multiple copies may result

When using a macro for payslip generation, a commonly seen issue/bug is the generation of multiple copies of the same payslip. If the volume of such errors is high, it is easy to imagine how the workload would quickly pile up as time and effort has to be expended to separate out the duplicate copies.

IT computations payslip unavailable

An IT computations payslip is one that shows the break-up of your income tax deductions. Such payslips are useful to have and are made readily available when using modern payroll software. The same cannot be created using a macro as the volume of data on the spreadsheet would be high due to the complex tax calculations involved. Thus, in the event that a software is not being used, IT computations payslips, if required, would need to be generated manually - a task that can take up to a month’s worth of working days, no less!

Secure publishing becomes an issue

So, you’ve generated payslips using your macro, and they’re all available neatly in the PDF format. But payslips aren’t done with you yet! They still need to be published to each of the employees - securely. This poses difficulties as there is no employee portal or the like where the payslips can be published while ensuring confidentiality. Add to this the fact that email does not provide a means to send out the payslips in bulk to employees, and you can see why a software with an employee self-service portal and bulk mailing options works much better to meet your publishing needs.

Misquoted identity numbers

Personal identity codes, such as an employee’s PF number, UAN number, etc., are to be displayed on his/her payslip. These codes are important and cannot be misquoted. However, when working with spreadsheets, one finds that it doesn’t capture by default, for instance, the multiple zeros that appear at the beginning of identity numbers such as one’s UAN number. This can lead to major issues when attempting to roll out payslips to your employees.

Other alternatives to software just as cumbersome/ineffective

As an alternative, you may use pre-built templates to generate payslips. These, however, prove to be just as unwieldy as other methods not involving a software. Here, you have to key in each of the values into each of the employee payslips manually. Cumbersome indeed! Another alternative is to roll out insipid, uninformative payslips to your employees which mention only their net pay. This proves to be ineffective as it will invariably result in innumerable employee queries which will the clog up your HR and payroll teams’ time and, just as importantly, result in disgruntled employees.

Payslip generation may appear to be a simple task at first glance. However, upon closer inspection, it becomes apparent that it is one of the payroll activities which leaves much room for error (where no errors will be entertained) and also constitutes a number of time-consuming steps when performed manually. What all this means is this: much time and effort will have to be poured into payslip generation if you’re performing the task without using a specialized payroll software, with no guarantee of error-free payslips whatsoever.