Have you started the tedious process of collecting the income tax proofs from your employees? Are you planning to compute your employee’s final TDS statements manually? Relax, here’s how you can do it in less time, yet as accurately.

The Tasks Involved

First, let’s see what tasks are involved in the year-end income tax (ITax) related activities:

- Communicate to employees well in advance before commencing this exercise

- Issue Income Tax declaration sheet to remind them what they had declared earlier

- Receive submitted Income Tax proofs

- Validate the proofs for correctness & seek clarifications from them wherever required

- Compute final Income Tax through Payroll

- Inform employees and respond to queries

- Issue digitally signed Form-16 to employees

Time Taken

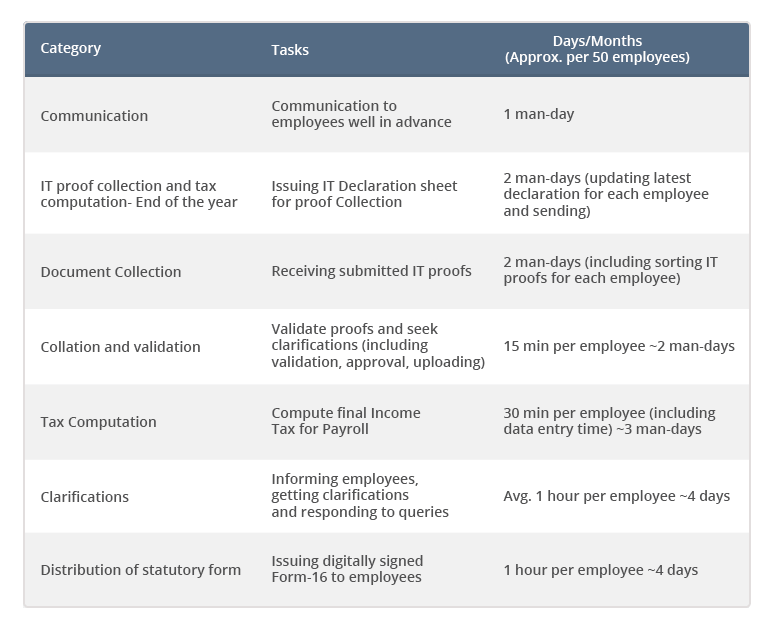

Each of the above tasks take a considerable amount of time to complete. Here’s a task-by-task break-up of all manual activities the year-end ITax activity calls for:

Woah! Looks like you will have to spend around 18 man-days of hard work!

Don’t you wish there could have been a quicker and smarter way to get this done?

Here’s a closer look at our solution that has been delivering accurate, error-free ITax computations for over 24 years now!

greytHR, India’s most popular HR and Payroll system software, reduces this effort by more than 90%.** Your TDS / ITax calculation and proof collection process is now a breeze.

.png)

See for yourself how greytHR now makes this so simple and easy.

Don’t take our word for it, it is not just us who is telling you all this. In discussions with many of our 5,000+ clients, we have received regular feedback about how the income tax automation module of greytHR have become an indispensable part of their Payroll operations.

“greytHR has immensely simplified and automated the TDS process, which helps us in taking timely tax declarations from employees. With the new POI feature, employees can easily add their income tax proofs online, which is very useful for us during proof verification. greytHR is a recommended tool for everyone to use as all tax processes and compliances are beautifully integrated in the system. It's so user friendly that all employees can compare, declare and submit their tax plans easily.”

Chhavi Saxena,

Manager - HR, Cuelearn Pvt. Ltd..

The best part is all the tasks are automated and seamlessly integrated with payroll management on greytHR!

If you would like to know more on how greytHR can help you easily and effortlessly manage all your TDS activities and payroll processes,

Trying is Believing.