Covid-19 has taken the entire world into its grip and business and economic activities have almost touched rock bottom. Policy makers started acting proactively to lift businesses and economic activities. PM’s Office, Finance Ministry, Ministry of Commerce, Ministry of MSME, RBI and various other concerned departments have created Special Economic Packages for the revival of the economy.

On May 12, Prime Minister Shri Narendra Modi unleashed “Aatma Nirbhar Bharat Abhiyaan” a mega economic package of Rs 20 Lakh Crores, which is equivalent to 10% of India’s GDP and later Finance Minister Smt Nirmala Sitharaman elaborated the packages in a series of Press conferences. The main focus has been on MSMEs. The recent appointment of Mr AK Sharma as Secretary for Ministry of MSME also indicates that a high growth push is on the cards card by the government. In his first address to the ministry of officials, Mr. AK Sharma mentioned his priorities clearly indicated that he is going to work on making Indian MSMEs a large global brand. PM Modi has also been very supportive. All these developments show a great sign for MSMEs.

Policy Highlights applicable to MSMEs:

Out of the total 15 measures announced by Prime Minister, nearly 7 measures are directed at MSMEs and few others support MSMEs. MSMEs are the backbone of the economy and contribute to almost 30% of India’s GDP and about 50% of exports. They play a very significant role in the development of the country (data by Directorate General of Commercial Intelligence and Statistics (DGCIS)). Here are the key highlights of the Policy decisions.

Increase in borrowing limits:

The borrowing limits of state governments will be increased from 3% to 5% of Gross State Domestic Product (GSDP) for the year 2020-21. This is estimated to give states extra resources of Rs 4.28 lakh crore. There will be unconditional increase of up to 3.5% of GSDP followed by 0.25% increase linked to reforms on - universalization of ‘One Nation One Ration card’, Ease of Doing Business, power distribution and Urban Local Body revenues. Further, there will be an increase of 0.5% if three out of four reforms are achieved.

Privatisation of Public Sector Enterprise (PSEs):

A new PSE policy has been announced with plans to privatise PSEs, except the ones functioning in certain strategic sectors which will be notified by the government. In strategic sectors, at least one PSE will remain, but private sector will also be allowed. To minimise wasteful administrative costs, number of enterprises in strategic sectors will ordinarily be only one to four; others will be privatised/ merged/ brought under holding companies.

Measures for businesses (including MSMEs)

Financial Highlights

Collateral free loans for businesses:

All businesses (including MSMEs) will be provided with collateral free automatic loans of up to three lakh crore rupees. MSMEs can borrow up to 20% of their entire outstanding credit as on February 29, 2020 from banks and Non-Banking Financial Companies (NBFCs). Borrowers with up to Rs 25 crore outstanding and Rs 100 crore turnover will be eligible for such loans and can avail the scheme till October 31, 2020. Interest on the loan will be capped and 100% credit guarantee on principal and interest will be given to banks and NBFCs.

Corpus for MSMEs:

A fund of funds with a corpus of Rs 10,000 crore will be set up for MSMEs. This will provide equity funding for MSMEs with growth potential and viability. Rs 50,000 crore is expected to be leveraged through this fund structure.

Subordinate debt for MSMEs:

This scheme aims to support to stressed MSMEs which have Non-Performing Assets (NPAs). Under the scheme, promoters of MSMEs will be given debt from banks, which will be infused into the MSMEs as equity. The government will facilitate Rs 20,000 crore of subordinate debt to MSMEs. For this purpose, it will provide Rs 4,000 crore to the Credit Guarantee Fund Trust for Micro and Small Enterprises, which will provide partial credit guarantee support to banks providing credit under the scheme.

Schemes for NBFCs:

A Special Liquidity Scheme was announced under which Rs 30,000 crore of investment will be made by the government in both primary and secondary market transactions in investment grade debt paper of Non-Banking Financial Companies (NBFCs)/Housing Finance Companies (HFCs)/Micro Finance Institutions (MFIs). The central government will provide 100% guarantee for these securities. The existing Partial Credit Guarantee Scheme (PCGS) will be extended to partially safeguard NBFCs against borrowings of such entities (such as primary issuance of bonds or commercial papers (liability side of balance sheets)). The first 20% of loss will be borne by the central government. The PCGS scheme will facilitate liquidity worth Rs 45,000 crores for NBFCs.

Employee Provident Fund (EPF):

Under the PM Garib Kalyan Yojana, the government paid 12% of employer and 12% of employee contribution into the EPF accounts of eligible establishments for the months of March, April and May. This will be continued for three more months (June, July and August). This is estimated to provide liquidity relief of Rs 2,500 crore to businesses and workers.

Statutory PF contribution:

Statutory PF contribution of both the employer and employee will be reduced from 12% to 10% each for all establishments covered by EPFO for next three months. This scheme will apply to workers who are not eligible for the 24% EPF support under PM Garib Kalyan Package and its extension. However, Central Public Sector Enterprises (CPSEs) and State Public Sector Units (PSUs) will continue to contribute 12% as employer contribution.

Street vendors:

A special scheme to facilitate easy access to credit for street vendors. Under this scheme, bank credit will be provided to each vendor for an initial working capital of up to Rs 10,000. This is estimated to generate liquidity of Rs 5,000 crore.

Policy Highlights

Expediting payment of dues to MSMEs:

: Payments due to MSMEs from the government and CPSEs will be released within 45 days.

Insolvency resolution:

: A special insolvency resolution framework for MSMEs under the Insolvency and Bankruptcy Code, 2016 will be notified.

Disallowing global tenders:

To protect Indian MSMEs from competition from foreign companies, global tenders of up to Rs 200 crore will not be allowed in government procurement tenders.

Reduction in TDS and TCS rates:

The rates of Tax Deduction at Source (TDS) for the non-salaried specified payments made to residents and Tax Collected at Source (TCS) will be reduced by 25% from the existing rates. This reduction will apply from May 14, 2020 to March 31, 2021. This is estimated to provide liquidity of Rs 50,000 crore.

Ease of doing business for corporates:

Direct listing of securities by Indian public companies in permissible foreign jurisdictions will be allowed. Private companies which list Non-Convertible Debentures (NCDs) on stock exchanges will not be considered listed companies. NCDs are debt instruments with a fixed tenure issued by companies to raise money for business purposes. Unlike convertible debentures, NCDs cannot be converted into equity shares of the issuing company at a future date.

Legislative Highlights

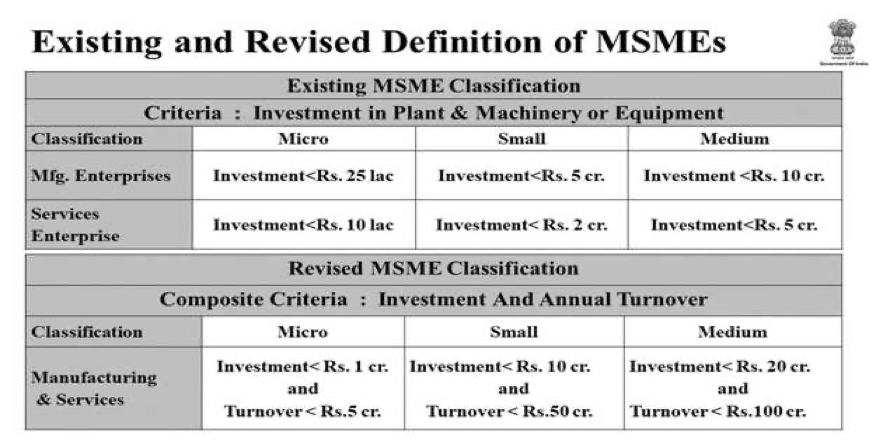

Definition of MSME:

The definition of MSMEs will be changed by amending the Micro, Small and Medium Enterprises Development Act, 2006. The current distinction between manufacturing and services MSMEs (to provide different investment limits for each category) will be removed.

Initiation of insolvency proceedings:

The Insolvency and Bankruptcy Code, 2016 will be amended to provide for the following: (i) minimum threshold to initiate insolvency proceedings will be increased from one lakh rupees to one crore rupees; (ii) suspension of fresh initiation of insolvency proceedings up to one year, depending upon the pandemic situation; (iii) COVID-19 related debt will be excluded from the definition of ‘default’ under the Code for triggering insolvency proceedings.

Amendments to Companies Act, 2013:

The Companies Act, 2013 will be amended to provide for the following.

- Certain offences under the Companies Act, 2013 will be decriminalised. These include minor technical and procedural defaults such as shortcomings in CSR reporting, inadequacies in Board report, filing defaults, delay in holding of AGM. Several compoundable offences will be shifted to internal adjudication mechanism.

- Currently, certain provisions from the Companies Act, 1956 continue to apply to producer companies. These provisions will be included in Companies Act, 2013. The National Company Law Appellate Tribunal (NCLAT) will be granted powers to create additional/specialised benches. All defaults by small companies, one-person companies, producer companies, and start-ups will be subject to lower penalties.

Source: Presentation made by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman under Aatmanirbhar Bharat Abhiyaan to support Indian economy in fight against COVID-19, Ministry of Finance and other publicly available sources.