At the beginning of each financial year, all employees are to declare their investments for the year. It is upon this amount that the tax for the year is calculated and then deducted on a pro-rata basis per month.

Assume an employee draws a CTC of 10 lakhs/annum and that his investments for the year, inclusive of HRA, PF, mutual funds and all others amount to 3 lakh/annum as of April 1st. Now, the taxable income of the employee amounts to 10 - 3 = 7 lakhs/annum.

Investment Proofs

Now, the proofs for these investments, commonly referred to as investment proofs, need to be submitted to your employer usually around December or January of the same financial year. The proofs are then tallied with the investments declared at the beginning of the year. The appropriate tax is then deducted from the salary of the employee. Every bill is to be verified by the payroll/finance department before the tax exemption can be made for the declared amount.

Popular Investment Types: Tips and Tricks

Section 80(C)

A popular investment vehicle, Section 80(C), allows for a deduction of up to Rs 1.5 lakh/annum from your gross income. There are also upper limits for each component within it. If mutual funds are being declared here, it is essential to verify whether they are a tax saving instrument or not (these are usually equity-linked savings schemes or ELSS). It is vital to bear in mind that the appropriate tax certificate is produced in this case.

PF is also a part of Section 80(C). This implies that, if you have opted for PF, you will not be able to avail of the entire 1.5 lakhs allowed under it. However, you are eligible for a stretch on the cap if you have invested in Rajiv Gandhi Equity - a central government scheme.

If you have exhausted your annual limit Sec 80C limit of Rs 1.5 lakh, you can also look at the National Pension System (NPS) to save towards retirement and, in the process, save additional tax. NPS falls under Section 80 CCD(1), and your contribution alone is to be mentioned in the declaration.

Deduction for Insurance & Health Check-Up

The total allowance towards health checkups here is given on the basis of age, where parents, seniors (aged 60+) and super seniors (aged 80+) have different rules depending on their age group. Obtaining the tax certificate is important here and can mean the difference between a tax exemption and the lack of it.

Housing Loans

If you are paying EMI for a housing loan, it has two components - principal and interest. These are dealt with differently. An exemption of up to Rs. 2 lakhs/annum can be claimed on the interest paid for the year. Exemption on the principal repayment falls under Section 80(C), and Rs.1.5 lakhs/annum is the cap here.

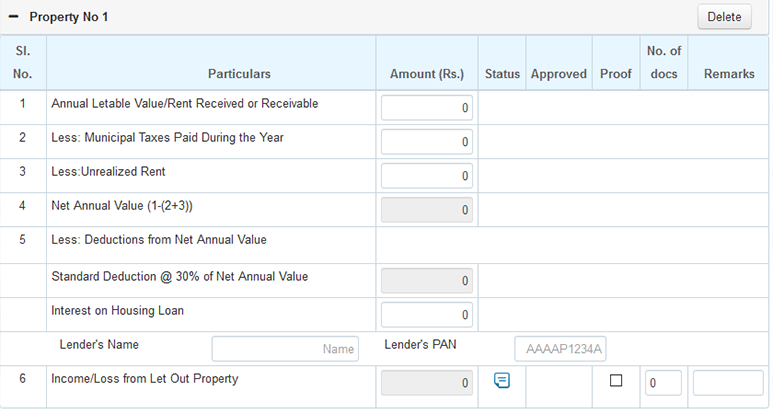

Income from let-out property

Section 24 of the Income Tax Act allows you to save tax by up to 30% of the Annual Net Value of your House Property. Now, how is the Annual Net Value calculated? It is essentially the Gross Annual Value or rent received from which municipal taxes paid for the year is deducted. In case of a property that is deemed to be let out, a reasonable rent of a similar property becomes your Gross Annual Value. Also, in case a home loan has been taken for construction, repair, etc., on your residential property, the interest on this can be deducted from the Net Annual Value post taking possession of the house. The total amount allowed towards this deduction is Rs 2,00,000. For an owned property that is self-occupied, the tax deduction is nil as the Gross Annual Value here is zero.

Donations

In case of contributions to charities, the trust is to be registered with the central government. Obtaining a tax certificate is also essential here. Only 50% exemption can be availed on donations to charities while those to political parties are granted 100% tax exemption.

Other important proofs

Leave Travel Allowance (LTA) constitutes another vital set of proofs that can be submitted to avail of tax relief. Do remember to bear in mind all the rules applicable to it before making your travel bookings. Another commonly used tax-saving mechanism is medical bills. Submission of medical bills - both yours as well as your dependents - can avail you of further tax relief. HRA or House Rent Allowance, which refers to the home rent you pay, can also bring you tax relief if declared along with a copy of the landlord’s PAN card (if rent amount exceeds Rs. 100,000/month).

Submission of Investment Proofs on greytHR

Here is the step-by-step process to be undertaken to submit all the above proofs and more on greytHR.

Summing it up

For admins, it is crucial to educate your employees about different types of investments they can make. Further, remind your employees about the deadlines to make sure the process runs smoothly for your organization.

For employees, remember to plan your declarations and submit your proofs well in advance. If your tax-saving efforts are last minute, the chances of locking funds in an unsuitable investment are relatively high. Also, save a soft (or scanned) copy of all submitted bills with you for future reference.